FM Nirmala Sitharaman unveils Doorstep Banking Services by PSBs, declares EASE 2.0 Index results

New Delhi: Union Minister of Finance & Corporate Affairs Nirmala Sitharaman on Wednesday (September 9, 2020) inaugurated Doorstep Banking Services by PSBs and took part within the awards ceremony to felicitate greatest performing banks on EASE Banking Reforms Index.

As a part of the EASE Reforms, Doorstep Banking Services is envisaged to offer the comfort of banking companies to the purchasers at their doorstep by means of the common touchpoints of Call Centre, Web Portal or Mobile App. Customers can even observe their service request by means of these channels.

The companies might be rendered by the Doorstep Banking Agents deployed by the chosen Service Providers at 100 centres throughout the nation.

Smt @nsitharaman launches PSB Alliance Doorstep Banking Services and declares EASE 2.0 Index Results. pic.twitter.com/8OssWCFtlK

— NSitharamanWorkplace (@nsitharamanoffc) September 9, 2020

At current solely non-financial companies like choose up of negotiable devices (cheque, demand draft, pay order, and so forth), choose up new cheque ebook requisition slip, choose up of 15G or 15H kinds, choose up of IT or GST challan, difficulty request for standing directions, request for account assertion, supply of non-personalised cheque ebook, demand draft, pay order, supply of time period deposit receipt, acknowledgement, and so forth, supply of TDS or Form 16 certificates issuance, supply of the pre-paid instrument or reward card can be found to prospects.

Financial companies shall be made accessible from October 2020.

The companies may be availed by prospects of Public Sector Banks at nominal expenses. The companies shall profit all prospects, significantly senior residents and “divyangs” who would discover it comfy to avail these companies.

Performance of PSB on EASE 2.0 Index:

A standard reform agenda for PSBs, EASE Agenda is geared toward institutionalizing clear and sensible banking. It was launched in January 2018, and the following version of this system ― EASE 2.Zero constructed on the muse laid in EASE 1.Zero and furthered the progress on reforms. Reform Action Points in EASE 2.Zero geared toward making the reforms journey irreversible, strengthening processes and techniques, and driving outcomes.

PSBs have proven a wholesome trajectory of their efficiency over 4 quarters for the reason that launch of EASE 2.0 Reforms Agenda. The general rating of PSBs elevated by 37% between March-2019 and March-2020, with the common EASE index rating bettering from 49.2 to 67.four out of 100. Significant progress is seen throughout six themes of the Reforms Agenda, with the very best enchancment seen within the themes of accountable Banking’, ‘Governance and HR’, ‘PSBs as Udyamimitra for MSMEs’, and ‘Credit off-take’.

PSBs have adopted tech-enabled, sensible banking in all areas, establishing retail and MSME Loan Management Systems for lowered mortgage turnaround time andPSBloansin59minutes.comandTReDS for digital lending. PSBs have instituted real-time visibility to retail and MSME prospects on the standing of their loans. Most branch-based companies are actually accessible from residence and cellular, together with in native languages.

EASE Reforms Index has geared up Boards and management for efficient governance, instituted threat urge for food frameworks, created technology- and data-driven threat evaluation and prudential underwriting and pricing techniques, launched Early Warning Signals (EWS) techniques and specialised monitoring for time-bound motion in respect of stress, put in place focussed restoration preparations, and established outcome-centric HR techniques.

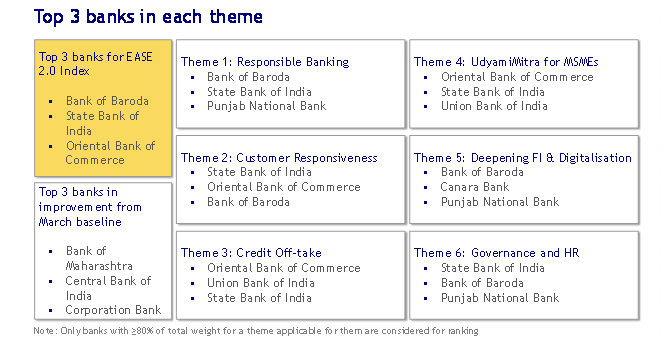

Bank of Baroda, State Bank of India, and erstwhile Oriental Bank of Commerce have been felicitated for being the highest three (in that order) within the ‘Top Performing Banks’ class in keeping with the EASE 2.0 Index Results. Bank of Maharashtra, Central Bank of India & erstwhile Corporation Bank have been awarded within the ‘Top Improvers’ class foundation EASE 2.0 Index. Punjab National Bank, Union Bank of India, and Canara Bank have been additionally acknowledged for excellent efficiency in choose themes.

Major Reform achievements between March 2018 to March 2020:

– Most PSB prospects now have entry to 35+ companies similar to IMPS, NEFT, RTGS, intra-bank switch, account assertion, cheque ebook request on cellular/ Internet banking and23 companies similar to chequebook issuance, cheque standing, issuance of type 16A, block/activate the debit card on the decision centre. The availability of companies has practically doubled over the past 24 months.

– Nearly 4cractive prospects on cellular and web banking with a 140% improve in monetary transactions by means of cellular and web banking channels and nearly 50% of economic transactions by means of digital channels.

– Call facilities now provide companies in 13regional languages similar to Telugu, Marathi, Kannada, Tamil, Malayalam, Gujarati, Bengali, Odia.

– Complaint redressal common turnaround time lowered from a median of roughly 9 days to five days.

– 23 branch-equivalent companies similar to account opening, money deposit, money withdrawal, fund switch made accessible by PSBs by means of Bank Mitras.

– PSBs have issued RuPay bank cards to almost 23 crore primary financial savings account prospects.

– Significant enchancment in buyer outreach by means of devoted advertising power and exterior partnerships. The variety of devoted advertising staff has elevated from 8,920 to 18,053.

– Sourcing of retail and MSME loans by means of the devoted salesforce and advertising tie-ups has elevated practically 5 instances from 1.5 lakhs to eight.Three lakh loans.

– Turnaround time (weighted common) for retail loans lowered by 67% from the common of practically 30 days to almost 10 days.

– Cross-sell of non-banking monetary merchandise has made accessible bouquet of economic merchandise to the shopper.

– For prudential lending, PSBs are actually systematically maintaining watch on adherence to risk-based pricing, and circumstances with deviation have lowered from 59% to 20%, and have put in place data-driven risk-scoring for appraisal of high-value loans that components in group-entities.

– Most PSBs have deployed IT-based EWS techniques leveraging third-party knowledge, which have enabled early, time-bound motion in burdened accounts.

– Monitoring has additionally been strengthened by deploying Agencies for Specialised Monitoring, and proactively monitoring listed entities based mostly on printed financials. Slippage into NPA has lowered from 3.90 lakh crore in 12-months ending March-18 to 1.45 lakh crore in 11-months ending February-20.

– PSBs have adopted digital platforms similar to on-line OTS, e-Bक्रय, e-DRT for expedited restoration. 88% of one-time settlement (OTS) circumstances are actually tracked by means of devoted IT techniques.

– PSBs have adopted new methods of credit score, similar to PSB loans in 59minutes.com and Trade Receivables Discounting System (TReDS) for digital lending for MSMEs and retail. 73% of all PSB inland payments are actually discounted by means of on-line TReDS.

– The Government has launched a number of governance reforms. The governance reforms embrace arm’s size choice of prime financial institution administration by means of Banks Board Bureau, the introduction of non-executive chairpersons, the broader expertise pool for such picks, empowered financial institution Boards, strengthening of the Board committees system, enhancing the effectiveness of non-official administrators, and management improvement and succession planning for the highest two ranges under the Board. In bigger PSBs, Executive Director energy has been elevated, and Boards are empowered to introduce CGM stage for elevated enterprise.

Like within the earlier yr, progress made by PSBs was tracked quarterly by means of a printed EASE Reforms Index main as much as the annual evaluate. In addition to the inclusion of the EASE Reforms Index within the analysis of Whole Time Directors of PSBs, it has now been made a part of the annual appraisal of PSB management as much as two ranges under the Whole Time Directors.

The Index measures the efficiency of every PSB on 120+goal metrics throughout six themes. It gives all PSBs a comparative analysis exhibiting the place banks stand vis-à-vis benchmarks and friends on the Reforms Agenda. The Index follows a totally clear scoring methodology, which permits banks to determine exactly their strengths in addition to areas for enchancment. The purpose is to proceed driving change by spurring wholesome competitors amongst PSBs and by encouraging them to study from one another.

PSBs have stepped as much as help the nation throughout COVID-19

PSBs have massively stepped as much as help the nation throughout the COVID-19 disaster. From totally different modes of staffing to distant working, 80,000+ financial institution branches have been operational throughout COVID-19. Additionally, there was 90% uptime of self-service machines throughout the COVID instances and round 3 times improve in Aadhaar Enabled Payment System (AEPS) transactions by means of micro ATMs, and enhanced doorstep banking help by 75,000+Bank Mitras. To additional help the purchasers in these instances, the banks have drastically elevated the variety of companies being provided on the name facilities, from 11 in March-19 to 23 as of June-20 in 13 regional languages.

PSBs manner ahead to Smart, Tech-enabled Banking for Aspiring India:

A complete agenda for sensible, tech-enabled banking has been adopted for FY2020-21, underneath which PSBs have initiated eShishu Mudra for straight-through processing of loans to micro-enterprises and digital private mortgage for purchasers. PSBs have began offering customer-need pushed credit score provides by means of analytics and partnerships with FinTechs and e-commerce corporations.

Many PSBs have already began taking steps according to the reform priorities. Progress of PSBs will proceed to be tracked on metrics linked to Reform Action Points, and their progress might be printed by means of a quarterly index.

Financial Health of the PSBs throughout the EASE Reforms journey:

Following the completion of recognition of legacy stress as NPA, PSBs have returned to profitability with sound monetary well being and institutionalised techniques to forestall the recurrence of previous weaknesses. The improved monetary well being of PSBs displays in lots of parameters—

– Gross NPAs lowered from Rs8.96 lakh crore in March-2018 to Rs 6.78 lakh crore in March-2020;

– A pointy decline in fraud incidence from 0.65% of advances throughout FY10-FY14 to 0.06% in FY19-20; attributable to fraud prevention reforms and proactive checking of legacy NPA

– Record restoration of Rs 2.27 lakh crore in FY19-FY20 pushed by newly setup devoted burdened account administration verticals in PSBs;

– Asset high quality has improved considerably, with the online NPA ratio decreasing from 7.97% in March 2018 to three.75% in March 2020

– Number of PSBs underneath PCA down to a few;

– CRAR 197 bps above the regulatory minimal; and

– The highest provision protection ratio of 80.9% in eight years.

Click right here for Doorstep Banking Services and Declaration of EASE 2.0 Index Results:

$(function() { return $("[data-sticky_column]").stick_in_parent({ parent: "[data-sticky_parent]" }); });

reset_scroll = function() { var scroller; scroller = $("body,html"); scroller.stop(true); if ($(window).scrollTop() !== 0) { scroller.animate({ scrollTop: 0 }, "fast"); } return scroller; };

window.scroll_it = function() { var max; max = $(document).height() - $(window).height(); return reset_scroll().animate({ scrollTop: max }, max * 3).delay(100).animate({ scrollTop: 0 }, max * 3); };

window.scroll_it_wobble = function() { var max, third; max = $(document).height() - $(window).height(); third = Math.floor(max / 3); return reset_scroll().animate({ scrollTop: third * 2 }, max * 3).delay(100).animate({ scrollTop: third }, max * 3).delay(100).animate({ scrollTop: max }, max * 3).delay(100).animate({ scrollTop: 0 }, max * 3); };

$(window).on("resize", (function(_this) { return function(e) { return $(document.body).trigger("sticky_kit:recalc"); }; })(this));

}).call(this);

} on_load_google_ad(); function sendAdserverRequest() { try { if (pbjs && pbjs.adserverRequestSent) return; googletag.cmd.push(function() { googletag.pubads().refresh(); }); } catch (e) {

googletag.cmd.push(function() { googletag.pubads().refresh(); }); } } setTimeout(function() { sendAdserverRequest(); }, 5000);

function on_load_fb_twitter_widgets(){ (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = "https://connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.9"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

window.twttr = (function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0], t = window.twttr || {}; if (d.getElementById(id)) return t; js = d.createElement(s); js.id = id; js.src = "https://platform.twitter.com/widgets.js"; fjs.parentNode.insertBefore(js, fjs); t._e = []; t.ready = function(f) {

t._e.push(f); }; return t; }(document, "script", "twitter-wjs")); }

//setTimeout(function() { on_load_google_ad(); }, 5000); setTimeout(function() { on_load_fb_twitter_widgets(); }, 5000);

Source